Making a difference, sustaining a plan

Governed by a decentralized authority, FlowUSD enables active stakeholder participation in decisions that impact its stability, such as minting thresholds and supply management.

For DeFi protocols

Empowering DeFi protocols by optimizing liquidity, enabling efficient yield farming, and maintaining consistent value across integrated ecosystems.

For LPs

Enhancing capital efficiency, ensuring stable returns, and facilitating seamless participation in decentralized markets.

Dynamic pricing adjustment

Maintains stability by adjusting supply based on market conditions.

Fully-decentralized

Allows community control over key decisions on smart contract.

Liquidity-led features

Automated liquidity offering and yield-bearing mechanisms

Set of integrations

Flow Finance and its governed synthetic stablecoin are fully compatible with EVM protocols and platforms. We are dedicated to expanding and sustaining the ecosystem of FlowUSD as a capable and trusted resource of liquidity adjustment.

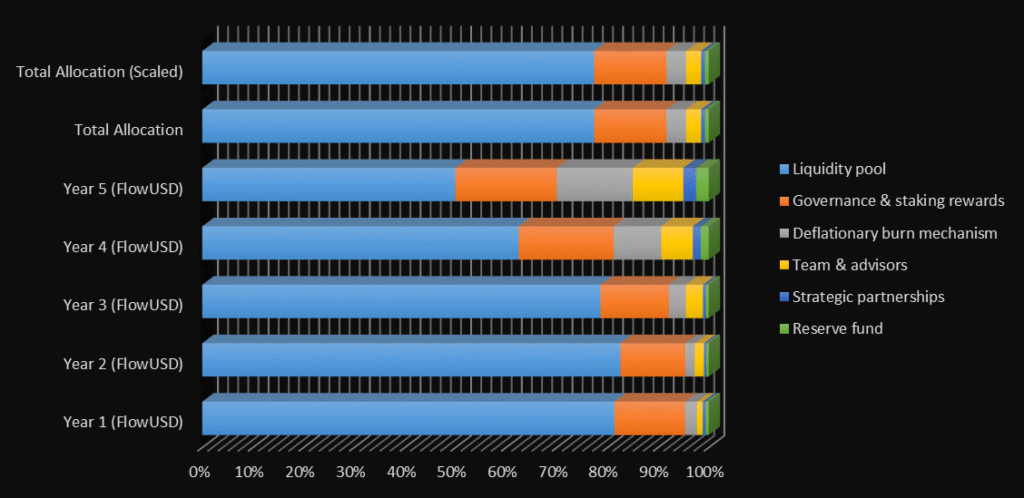

Five-year token distribution plan

| Category | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total |

| Liquidity pool | 416666667 | 535714286 | 416666667 | 119047619 | 59523810 | 1547619049 |

| Governance & staking | 71428571 | 83333333 | 71428571 | 35714286 | 23809524 | 285714285 |

| Deflationary mechanism | 11904762 | 11904762 | 17857143 | 17857143 | 17857143 | 77380953 |

| Team & advisors | 5952381 | 11904762 | 17857143 | 11904762 | 11904762 | 59523810 |

| Strategic partners | 2976190 | 2976190 | 2976190 | 2976190 | 2976190 | 14880950 |

| Reserve fund | 2976190 | 2976190 | 2976190 | 2976190 | 2976190 | 14880950 |